Subscribe | The Record Archive | Contacts | bcbsm.com

|

January 2025

Reminder: Medicare Plus Blue migrated individual, some group membership from ikaSystems to NASCOOn Jan. 1, 2025, Blue Cross Blue Shield of Michigan will complete the transition of its billing and claims processing for Medicare Plus Blue℠ individual plans and 165 national Michigan group plans from ikaSystems to the NASCO platform. Affected members have received new member ID cards that must be used in claims submission as part of this process. Please scan their new member ID cards to be sure claims will be routed correctly. Timeline and implementation We started processing groups new to Medicare Plus Blue in 2024 on the NASCO platform. Beginning Jan. 1, 2025, we are moving our Medicare Plus Blue individual plans and some national Michigan group plans from ikaSystems to the NASCO platform. In 2026, we plan to transition the remaining national Michigan groups and our key accounts to the NASCO platform to ensure continuity and efficiency. Changes to provider vouchers Refer to the article in the October 2024 issue of The Record, which details the changes and provides a sample of the Medicare Plus Blue voucher. Here’s a summary of the changes:

Outpatient claims will continue to be listed on the claim line level. Important member ID cards update The October 2024 article in The Record also provides a sample of the new individual and group member ID cards. Changes include:

Eligibility Prior to Jan. 1, 2025, if providers can’t find a member’s eligibility for 2025, they should be able to find the member in the system by searching the member’s name and date of birth. Beginning Jan. 1, 2025:

Claims If a provider submits a claim for services on or after Jan. 1, 2025, using the member’s old member ID, it will deny with the message “Contract not found.” The provider needs to resubmit the claim with the new member ID number. Further reminders The voucher for payments received from the NASCO platform will show the check or EFT number series below:

All Medicare Advantage claims will be finalized on a Tuesday and either a check or EFT will be issued at that time. EFT funds will be received on Friday of the same week unless that day is a federal holiday.

Sign up to benefit from EFTWhen you sign up for Blue Cross Blue Shield of Michigan and Blue Care Network's electronic funds transfer and online voucher program, you can electronically send payments to your choice of financial accounts and view and print remittance advices, or vouchers, online. Benefits of EFT The benefits of electronic funds transfer include:

How to sign up To sign up for EFT, follow these steps:

Note: If you’re a new provider with Blue Cross or BCN, you’ll need to perform a check verification before enrolling in EFT. Where to find additional information For more information, see the What is the Electronic Funds Transfer and Online Voucher Program? webpage on bcbsm.com. Note: The “How do I register?” section of the above webpage contains instructions for signing up for Availity, which is required for EFT. **Blue Cross Blue Shield of Michigan and Blue Care Network don’t own or control this website. Availity® is an independent company that contracts with Blue Cross Blue Shield of Michigan and Blue Care Network to offer provider portal and electronic data interchange services.

Providers can upload medical records through Availity Essentials for additional types of requestsOn Dec. 16, 2024, Blue Cross Blue Shield of Michigan further expanded the ability to upload medical records through our provider portal, Availity Essentials™. Specifically, health care providers can upload medical records for Blue Cross commercial and Medicare Plus Blue℠ members for these reasons:**

How to upload medical records Providers can submit medical records using the Send Attachments feature, which is available on the Claim Status screen in Availity Essentials. For step-by-step instructions, see the Submitting medical records through Availity Essentials document. Notes:

Availity Essentials training webinars Availity® is offering a live webinar and a recorded webinar where you can learn about the latest changes. Register for a live webinar Availity is offering a live webinar on Wednesday, Jan. 8, 2025, from 2 to 3 p.m. To register for this webinar:

Watch a recorded webinar You can view Availity’s Learn How to Submit Claim Attachments for BCBSM Providers recorded training for information about the new functionality. To access the recorded webinar:

Additional information

**For Medicare Plus Blue, this functionality is available for claims with 16-digit claim numbers. ***Blue Cross Blue Shield of Michigan and Blue Care Network don’t own or control this website. Availity® is an independent company that contracts with Blue Cross Blue Shield of Michigan and Blue Care Network to offer provider portal and electronic data interchange services.

Reminder: How to check status of prior authorization requests to share with your patientsAs a reminder, if a patient who has coverage through Blue Cross Blue Shield of Michigan or Blue Care Network asks about the status of a prior authorization request, you can check it by following these steps:

Additional information available for health care providers Providers can also find a summary of services that require prior authorization through our Summary of utilization management programs for Michigan providers document on ereferrals.bcbsm.com. Note: For help using the e-referral tool, go to ereferrals.bcbsm.com and, under Access & Training, click on Training Tools. **Blue Cross Blue Shield of Michigan and Blue Care Network don’t own or control this website. Availity® is an independent company that contracts with Blue Cross Blue Shield of Michigan and Blue Care Network to offer provider portal and electronic data interchange services.

Some members qualify for new Virtual Muscle and Joint Health ProgramWhat you need to know Some of your patients may participate in a new virtual exercise program to help them with preventive, acute or chronic musculoskeletal needs. This program can supplement the care provided by you, our network providers. Starting Jan. 1, 2025, some of your patients with Blue Cross Blue Shield of Michigan and Blue Care Network commercial coverage will have access to a new Virtual Muscle and Joint Health Program. Blue Cross and BCN are offering this program as an option to large self-funded employer groups. We’ve contracted with Hinge Health™ to provide this program, which offers personalized virtual exercise therapy to individuals 18 or older from the comfort of their home (in the U.S. only). It complements care provided by our in-person network health care providers and physical therapists. It’s designed to help members with musculoskeletal conditions:

Participation in this program is optional and at no cost to members if their employer group offers it. Members don’t need a referral or prior authorization. They can self-refer by downloading the Hinge Health app and completing an application. Based on Hinge Health’s assessment, the member may receive a customized virtual program from a dedicated team of physical therapists, orthopedic surgeons and board-certified health coaches. The program can include:

Your awareness and support for your patients are crucial We know it’s in-person network providers who are managing patient care. If a member has six virtual visits with a Hinge Health physical therapist, the member must see an in-person provider such as a physical therapist or primary care provider to continue care through the Hinge Health app. If your patients tell you about their participation in this program, we ask that you talk to your patients about how the Virtual Muscle and Joint Health Program can contribute to their overall plan of care. You don’t need to provide any formal documentation to the member or Hinge Health about this discussion. Notes:

Learn more More information is available by watching a short video,** viewing Hinge Health’s website,** or viewing our Muscle and Joint Health webpage for members. Questions? If you have questions about the program in general or regarding care for a specific patient, providers can call Hinge Health at 1-855-902-2777 from 9 a.m. to 9 p.m. Eastern time Monday through Friday. **Blue Cross Blue Shield of Michigan and Blue Care Network don’t own or control this website. Hinge Health, Inc. is an independent company supporting Blue Cross Blue Shield of Michigan and Blue Care Network by providing virtual muscle and joint health services to individuals with musculoskeletal conditions.

U.P. Blue rider being retired, effective Dec. 31, 2024The Upper Peninsula Blue℠ rider is being retired, effective Dec. 31, 2024. Blue Cross Blue Shield of Michigan PPO members who had this benefit design will no longer need a U.P. Blue referral, starting Jan. 1, 2025.

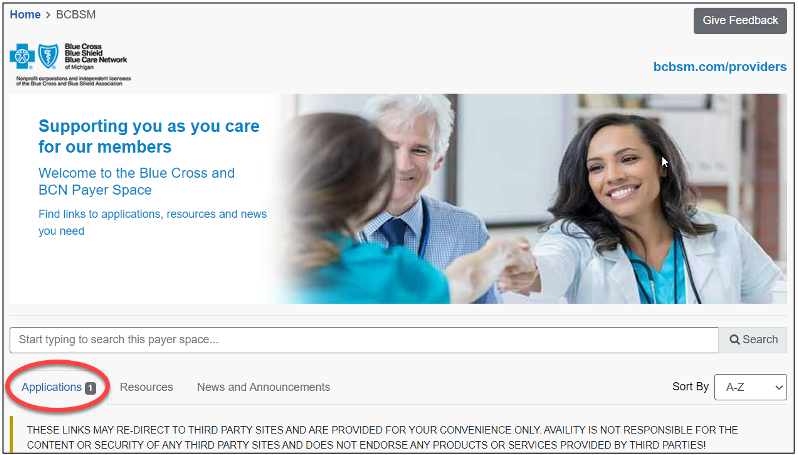

Billing chart: Blue Cross highlights medical, benefit policy changesYou’ll find the latest information about procedure codes and Blue Cross Blue Shield of Michigan billing guidelines in the “Billing chart.” The billing chart is organized numerically by procedure code. Newly approved procedures will appear under the New Payable Procedures heading. Procedures for which we have changed a billing guideline or added a new payable group will appear under Updates to Payable Procedures. Procedures for which we are clarifying our guidelines will appear under Policy Clarifications. New procedures that are not covered will appear under Experimental Procedures. We’ll publish information about new Blue Cross groups or changes to group benefits under the Group Benefit Changes heading. For more detailed descriptions of Blue Cross’ policies for these procedures, check under the Commercial Policy tab in Benefit Explainer on Availity®. To access this online information:

2 .Click on Payer Spaces on the Availity menu bar. 3. Click on the BCBSM and BCN logo. 4. Click on Benefit Explainer on the Applications tab. 5. Click on the Commercial Policy tab. 6. Click on Topic. 7. Under Topic Criteria, click on the circle for Unique Identifier and click the drop-down arrow next to Choose Identifier Type, then click on HCPCS Code. 8. Enter the procedure code. 9. Click on Finish. 10. Click on Search. To view the “January 2025 Billing chart,” click here. **Blue Cross Blue Shield of Michigan doesn’t own or control this website.

We’ll return clinical editing appeals that don’t include a rationaleEffective immediately, when we receive a clinical editing appeal that doesn’t include a rationale, we’ll return it to the provider without review. We’re doing this because when an appeal doesn’t include a rationale, it makes it difficult to determine the basis for the appeal. What a rationale must show A rationale must describe why you think the services meet the criteria for reimbursement. It must be related to:

All clinical editing appeals must have a rationale that conforms to these requirements or they will be returned to the provider without review. How to submit a clinical editing appeal To appeal a claim denied for clinical editing, access the Clinical Editing Appeal Form and follow the instructions on the form to complete and submit it. Be sure to do the following:

Chiropractors invited to join new quality reward programAction item To reap the benefits of the new quality reward program, chiropractors need to opt-in by June 30, 2025. For details, visit the chiropractic quality rewards website. Blue Cross Blue Shield of Michigan is offering all participating chiropractors the opportunity to join a new quality reward program related to imaging of low back pain. For the 2025 measurement year, the performance around the HEDIS® metric of Use of Imaging Studies for Low Back Pain (LBP) will be evaluated for engaged chiropractors, with the opportunity to earn a value-based reimbursement of 5% on eligible PPO professional claims for the pay period of Sept. 1, 2026, through Aug. 31, 2027. Value-based reimbursement offers health care providers the opportunity to earn greater than the standard professional fee schedule, based on achieving goals related to high-quality performance. For this value-based reimbursement opportunity, all participating Blue Cross chiropractors are eligible. Achievement based on a target score or on improvement will be evaluated at the regional level to ensure all chiropractors may participate. Analytics will be performed by the Michigan Data Collaborative. Chiropractors must opt-in by June 30, 2025, to be eligible. For more details, enrollment steps and contact information, visit the chiropractic quality rewards website. Notes:

HEDIS®, which stands for Healthcare Effectiveness Data and Information Set, is a registered trademark of the National Committee for Quality Assurance, or NCQA.

Some continuous glucose monitoring products available through participating network pharmaciesCertain Blue Cross Blue Shield of Michigan and Blue Care Network members may have a lower out-of-pocket responsibility when they acquire the products listed below through one of our participating network pharmacies. Members must have pharmacy benefit coverage to obtain continuous glucose monitoring products at a retail pharmacy.

Members have another option If members choose to continue to fill their CGM products through durable medical equipment suppliers under their medical benefits, there won’t be any penalty. Members can verify their out-of-pocket responsibility for continuous glucose monitoring products covered under pharmacy benefits through their member accounts at bcbsm.com. What members need to do if they want to fill through a participating network pharmacy Members can verify their out-of-pocket responsibility under their pharmacy benefits by following these steps:

If members decide to fill continuous glucose monitoring prescriptions through their pharmacy benefits, their doctors can send the prescriptions directly to one of our participating network pharmacies. A prior authorization may be required, and quantity limits may apply. Members can find a participating network pharmacy by following these directions:

Members should talk to their doctors about any concerns they may have. We’ll send letters to affected groups, members and their health care providers to inform them about this option. The Michigan Education Special Services Association, known as MESSA, won’t be participating in this initiative. **These products are covered with no out-of-pocket cost for the member.

Out-of-pocket costs for ABA services will change for some members in 2025Starting Jan. 1, 2025, some members will see a change in their out-of-pocket costs for applied behavioral analysis services. The change will apply to all Blue Cross Blue Shield of Michigan and Blue Care Network commercial groups, as well as fully insured and self-funded individual plans that already have an out-of-pocket cost or copayment for behavioral health. Members of affected groups will have to pay the same out-of-pocket costs for ABA services that they now pay for other behavioral health services. This change is due to a government regulation that will require Blue Cross and BCN to consider ABA services the same as behavioral health office visits, including any out-of-pocket costs for each visit.

Clinical editing updates: Antepartum visits; modifier 59; repeat radiology proceduresIn support of correct coding and payment accuracy, we are providing the information below to keep you informed about forthcoming payment policy updates, new policies and coding reminders. Blue Cross Blue Shield of Michigan commercial Reminder: Antepartum visits should be reported with a date span Antepartum procedure codes *59425 and *59426 must be reported with a date span indicating the first initial visit in the from field and the last visit before delivery in the to field. Claims submitted without the required date span may be denied. Following are the code descriptions:

Reminder: Inappropriate modifier combination with modifier 59 Modifier 59 is used to identify procedures and services, other than evaluation and management services, that aren’t normally reported together but are appropriate under the circumstances. When another already established modifier is appropriate (XE, XP, XS or XU), it should be used rather than modifier 59. In accordance with the Centers for Medicare & Medicaid Services, it’s not appropriate for modifier 59 to be reported with modifiers XE, XP, XS or XU on the same claim line. When these modifiers are billed together, claims may be denied. Following are the modifier descriptions:

Medicare Plus Blue℠ Reminder: Repeat radiology procedures To ensure correct processing of claims, append the appropriate modifier when submitting claims for repeat radiology procedures. Medicare considers two physicians in the same group with the same specialty performing services on the same day as the same physician. Physicians in the same group practice who are in the same specialty must bill and be paid as though they were a single physician. Physicians in the same group practice but who are in different specialties may bill and be paid without regard to their membership in the same group. Claims submitted for repeat radiology procedures without the appropriate modifier may be denied. Modifier 76 definition: Repeat Procedure by the Same Physician; use when it is necessary to report repeat procedures performed on the same day. Modifier 77 definition: Repeat procedure or service by another physician or other qualified health care professional. Note: Please submit a corrected claim; don’t send clinical editing appeals.

Pharmacy news roundupWhat you need to know To view all — including the most recent — pharmacy-related provider alerts:

Starting with this issue of The Record, we’re gathering recent pharmacy-related provider alerts into a single article. Many of these alerts would previously have been published as separate articles. We’re doing this to make it easier for you to review the changes we’ve announced and to save time for readers who also subscribe to Provider Alerts Weekly and are already aware of this information. We’ll continue to publish some pharmacy-related information separately, such as when there isn’t an equivalent provider alert, there are changes we want to make sure you don’t miss or there are updates or additional information following the provider alert. Here are links to pharmacy-related provider alerts from November:

Tip: You can also subscribe to Provider Alerts Weekly to receive a weekly email with links to the previous week’s provider alerts. Availity® is an independent company that contracts with Blue Cross Blue Shield of Michigan and Blue Care Network to offer provider portal and electronic data interchange services.

Updates to our coverage of limb compression devices, starting Feb. 1, 2025Blue Cross Blue Shield of Michigan and Blue Care Network will change the reimbursement for intermittent limb compression devices to only allow for a one-month rental at a time. Beginning Feb. 1, 2025, payment for the compression device billed with procedure code E0676 will be limited to rental only for services on or after that date; these devices will no longer be eligible for purchase. Members still need to meet the clinical criteria in our medical policies. A new certificate of medical necessity will be required with each monthly rental claim. The certification must indicate that the patient continues to need the device beyond the 30 days and that other conservative measures have been attempted. Payment for all claims that don’t include the medical necessity requirements will be denied. For patients who engage in the postsurgical home use of limb compression devices for venous thromboembolism prophylaxis, one of the following criteria must be met:

Our policy, Postsurgical Home Use of Limb Compression Devices for Venous Thromboembolism Prophylaxis, provides key measurements to assess the risk of bleeding. Additionally, the policy provides the tools to define the Caprini Score as used to assess the risk of VTE.

Commercial prior authorization requests submitted through NovoLogix must be submitted through a different application, starting April 1For most commercial members, health care providers will need to submit prior authorization requests for medical benefit drugs that are currently submitted through the NovoLogix® online tool through a different application. This applies to dates of service on or after April 1, 2025. Blue Cross Blue Shield of Michigan and Blue Care Network will continue to manage the prior authorization and site-of-care requirements for these drugs. Through March 31, 2025, continue to submit these prior authorization requests through NovoLogix. This includes requests involving site-of-care requirements. Watch for additional communications about training opportunities and resources for the application in first-quarter 2025. NovoLogix is an independent company that provides an online prescription drug prior authorization tool for Blue Cross Blue Shield of Michigan and Blue Care Network.

OncoHealth manages our Oncology Value Management program, starting Jan. 1As a reminder, OncoHealth will manage authorizations for oncology and supportive care drugs for most Blue Cross Blue Shield of Michigan commercial and Blue Care Network commercial members and all Medicare Plus Blue℠ and BCN Advantage℠ members through the Oncology Value Management program. This applies to dates of service on or after Jan. 1, 2025. For additional information, see the October Record and the November Record. Start submitting prior authorization requests to OncoHealth on Jan. 1 On Jan. 1, 2025, health care providers will be able to submit prior authorization requests in the OncoHealth Provider Portal, OneUM™, through Availity Essentials™. To access the OncoHealth Provider Portal:

Members who started receiving treatment before Jan. 1, 2025, can continue to receive treatment under their approved authorization until it expires. Authorization isn’t required from OncoHealth unless:

Attend or view a webinar Providers who submit prior authorization requests for oncology drugs should attend a live webinar to learn more. The webinar will:

If you haven’t attended a webinar already, there’s still time. Click one of the links below to register.

If you can’t attend a live webinar, you can view a recorded webinar. To access it, log in to our Provider Training site and search for “oncology.” To access the Provider Training site:

If you have issues accessing or navigating the site, email ProviderTraining@bcbsm.com. Additional information For additional information, see the document Oncology Value Management program through OncoHealth: Frequently asked questions for providers. You can find the FAQ document, lists of medical benefit oncology and supportive care drugs that require prior authorization, and more on the following pages on ereferrals.bcbsm.com: ** Blue Cross Blue Shield of Michigan and Blue Care Network don’t own or control this website. Availity® is an independent company that contracts with Blue Cross Blue Shield of Michigan and Blue Care Network to offer provider portal and electronic data interchange services. OncoHealth is an independent company supporting Blue Cross Blue Shield of Michigan and Blue Care Network by providing cancer support services.

On-demand opportunities available for trainingAction item Visit our provider training site to find resources on topics that are important to your role. Provider Experience continues to offer training resources for health care providers and staff. On-demand courses are designed to help you work more efficiently with Blue Cross Blue Shield of Michigan and Blue Care Network. The following learning opportunities are available: “2025 Formulary Changes – Provider Education recorded webinar:” This recorded webinar from October 2024 discusses top formulary changes, member outreach strategies and pharmacy outreach strategies. Formulary alternatives and a list for prescribing are reviewed, as well as what providers can do. This is a great time to review the changes. Patients may have questions. Patient Experience Master Class recordings: All webinar recordings from the Patient Experience Master Class site are now available to view on the Provider Training site. These webinars focus on topics related to Consumer Assessment of Healthcare Providers and Systems, or CAHPS®, survey; Health Outcomes Survey; managing challenging patient interactions; combatting burnout; equitable care for older adults; and inclusive care for LGBTQ+ older adults. These recordings are eligible for AMA PRA Category 1 Credits™.** Use the keyword “PE” to locate all courses related to patient experience topics. You can also locate these in the Patient Experience category of the Course Catalog. How to access provider training To access the training site, follow these steps:

Those who don’t have a provider portal account can directly access the training through the Provider Training website. Questions? For more information about using the provider training website, contact the provider training team at ProviderTraining@bcbsm.com. **This activity has been planned and implemented in accordance with the accreditation requirements and policies of the Accreditation Council for Continuing Medical Education, or ACCME, through the joint providership of the Minnesota Medical Association and Blue Cross Blue Shield of Michigan. Physicians should claim only the credit commensurate with the extent of their participation in the activity. ***Blue Cross Blue Shield of Michigan and Blue Care Network don’t own or control this website. CAHPS® is a registered trademark of the Agency for Healthcare Quality and Research, or AHQR. Availity® is an independent company that contracts with Blue Cross Blue Shield of Michigan and Blue Care Network to offer provider portal and electronic data interchange services.

Do you have time for a Quality Minute about closing gaps in care for 2024?This is another article in an ongoing series of quick tips designed to be read in 60 seconds or less and provide your practice with information about performance in key areas. Reminder: There’s still time to close gaps in care for measurement year 2024 We encourage you to review open gaps in care in Health e-Blue, and make sure services that were completed in 2024 are captured. The following are the biggest opportunities we’ve identified where services have been completed, but gaps may remain open due to inadequate data submission:

For measurement year 2025, using CPT II codes on claims to report blood pressure, A1c and eye exam results can reduce the administrative burden of entering values into Health e-Blue. Data must be entered in Health e-Blue for 2024 gaps in care by midnight Jan. 25, 2025. Data entry will be disabled in Health e-Blue after this deadline date. Electronic medical record and quality monitoring interface files must be submitted by Jan. 17, 2025. Data submitted after this deadline won’t count for 2024 incentives.

Article correction: Announcing changes to preferred drug designations under medical benefits for most membersIn the November 2024 Record, we published an article with an incorrect drug name. One of the preferred drugs for commercial members for pegfilgrastim is Udenyca Onbody™, not Udenyca OnPro™. We’ve updated the article below with the correct information. For dates of service on or after Jan. 1, 2025, Blue Cross Blue Shield of Michigan and Blue Care Network are making changes to preferred drug designations for some drugs. In addition, health care providers will need to submit prior authorization requests through different systems for some preferred and nonpreferred drugs. These changes will affect:

Changes to preferred drug designations The following table shows how we’re changing preferred drug designations. Changes are in bold text.

How existing prior authorizations are affected by these changes

Changes to prior authorization processes The following table outlines prior authorization requirements for the drugs listed above for dates of service on or after Jan. 1, 2025. Note: To determine which Blue Cross and BCN commercial groups participate in the Oncology Value Management program through OncoHealth® for dates of service on or after Jan. 1, 2025, see this list.

Additional information See the “Find out which medical benefit oncology drugs will require prior authorization through OncoHealth, starting Jan. 1” article for more details about drugs that will have requirements through the Oncology Value Management program for dates of service on or after Jan. 1, 2025. For additional information about medical benefit drugs, read these pages of our ereferrals.bcbsm.com website: OncoHealth is an independent company supporting Blue Cross Blue Shield of Michigan and Blue Care Network by providing cancer support services.

Here are 2025 FEP benefit changesBlue Cross and Blue Shield Federal Employee Program® 2025 benefit changes will take effect Jan. 1, 2025. Below is an overview of the changes. Cost share

Emergency room

Gende-affirming care

Inpatient admission

Office visits

Outpatient laboratory services

Outpatient observation services

Outpatient surgical and treatment

Pharmacy

Reproductive care

Urgent care center

For complete 2025 Blue Cross and Blue Shield Service Benefit Plan benefit information, go to fepblue.org/brochure or call Customer Service at 1-800-482-3600.

Questionnaires removed from e-referral systemOn Nov. 24, 2024, we removed the questionnaires in the table below from the e-referral system. Note: The listed procedure codes will continue to require prior authorization.

The Authorization criteria and preview questionnaires document on the ereferrals.bcbsm.com website was updated to reflect these changes. As a reminder, we use our authorization criteria, our medical policies and your answers to the questionnaires in the e-referral system when making utilization management determinations on your prior authorization requests.

We’ll return clinical editing appeals that don’t include a rationaleEffective immediately, when we receive a clinical editing appeal that doesn’t include a rationale, we’ll return it to the provider without review. We’re doing this because when an appeal doesn’t include a rationale, it makes it difficult to determine the basis for the appeal. What a rationale must show A rationale must describe why you think the services meet the criteria for reimbursement. It must be related to:

All clinical editing appeals must have a rationale that conforms to these requirements or they will be returned to the provider without review. How to submit a clinical editing appeal To appeal a claim denied for clinical editing, access the Clinical Editing Appeal Form and follow the instructions on the form to complete and submit it. Be sure to do the following:

Blue Cross, BCN will no longer separately pay providers for services performed by bedside nurse, starting March 1Effective March 1, 2025, Blue Cross Blue Shield of Michigan and Blue Care Network will no longer separately pay health care providers on inpatient facility claims for services performed by a bedside nurse. This payment policy isn’t intended to affect decision-making for care of the patient, and providers are expected to apply independent medical judgment when caring for all members. This policy applies to all inpatient facility claims submitted for Blue Cross and BCN commercial members. Background Nursing services are prescribed by a physician or nonphysician practitioner for the assessment, treatment and monitoring of patients. This policy pertains to all services performed by a bedside nurse in all prescribed settings (for example, an emergency room; regular room and board; intensive care unit; or operating room). Nursing services aren’t separately payable on an inpatient facility claim when performed by a bedside nurse. These services are inclusive to the room and board, treatment area or laboratory charge. The following list provides examples of nursing services that aren’t separately payable on an inpatient facility claim when performed by a bedside nurse. This isn’t an all-inclusive list.

Here’s our sepsis DRG reimbursement policyEffective Nov. 1, 2024, Blue Cross Blue Shield of Michigan implemented a sepsis diagnosis-related group, or DRG, reimbursement process for inpatient claims billed with certain sepsis DRGs for all lines of business. Inpatient admissions that are billed using the following DRGs with a length of stay of three days or less and a discharge status of home (01) or skilled nursing facility (03) may be denied:

According to the Centers for Medicare & Medicaid Services, the geometric mean length of stay, or GMLOS, for sepsis Medicare severity diagnosis-related groups, or MS-DRGs, 870 and 871 are 13.5 days and 5.1 days, respectively; DRG 872, for the mildest form of sepsis, is 3.6 days. Considerations If a claim was previously paid for either DRG 870 or 871 with a length of stay of three days or less and a discharge status of home (01) or skilled nursing facility (03), the claim may be adjusted to deny. Any reimbursement previously made to the health care provider may be recovered. If the health plan either denied a claim or recovered reimbursement, the provider will be able to rebill with a more appropriate DRG, such as dehydration, urinary tract infection or other diagnosis that more accurately reflects the patient’s condition. Exclusions The mildest form of sepsis, listed as DRG 872, isn’t subject to this policy secondary to its shorter average 3.6-day length of stay:

Any sepsis DRG claim with a three day or less length of stay and the following discharge status codes will be reimbursed accordingly:

Any sepsis DRG inpatient hospital claim with a three day or less length of stay and an associated observation level of care will be reimbursed at the billed DRG.

Blue Cross, BCN will no longer separately pay providers for services performed by respiratory therapist, starting March 1Effective March 1, 2025, Blue Cross Blue Shield of Michigan and Blue Care Network will no longer separately pay providers for services performed by a respiratory therapist on inpatient facility claims. This payment policy isn’t intended to affect decision-making for care of the patient, and providers are expected to apply independent medical judgment when caring for all members. This policy applies to all inpatient facility claims submitted for Blue Cross and BCN commercial members. Background Respiratory therapy services are prescribed by a physician or nonphysician practitioner for the assessment and diagnostic evaluation, treatment, management and monitoring of patients with deficiencies and abnormalities of cardiopulmonary function. This policy pertains to services performed by a respiratory therapist in all prescribed settings (for example, an emergency room; regular room and board; an intensive care unit; or operating room). Respiratory therapy services aren’t separately payable on the inpatient facility claim, as they are inclusive to the respiratory modality, room and board, treatment area or laboratory. The following list provides examples of respiratory therapy services that aren’t separately payable on the inpatient facility claim. This isn’t an all-inclusive list.

Some continuous glucose monitoring products available through participating network pharmaciesCertain Blue Cross Blue Shield of Michigan and Blue Care Network members may have a lower out-of-pocket responsibility when they acquire the products listed below through one of our participating network pharmacies. Members must have pharmacy benefit coverage to obtain continuous glucose monitoring products at a retail pharmacy.

Members have another option If members choose to continue to fill their CGM products through durable medical equipment suppliers under their medical benefits, there won’t be any penalty. Members can verify their out-of-pocket responsibility for continuous glucose monitoring products covered under pharmacy benefits through their member accounts at bcbsm.com. What members need to do if they want to fill through a participating network pharmacy Members can verify their out-of-pocket responsibility under their pharmacy benefits by following these steps:

If members decide to fill continuous glucose monitoring prescriptions through their pharmacy benefits, their doctors can send the prescriptions directly to one of our participating network pharmacies. A prior authorization may be required, and quantity limits may apply. Members can find a participating network pharmacy by following these directions:

Members should talk to their doctors about any concerns they may have. We’ll send letters to affected groups, members and their health care providers to inform them about this option. The Michigan Education Special Services Association, known as MESSA, won’t be participating in this initiative. **These products are covered with no out-of-pocket cost for the member.

Clinical editing updates: Antepartum visits; modifier 59; repeat radiology proceduresIn support of correct coding and payment accuracy, we are providing the information below to keep you informed about forthcoming payment policy updates, new policies and coding reminders. Blue Cross Blue Shield of Michigan commercial Reminder: Antepartum visits should be reported with a date span Antepartum procedure codes *59425 and *59426 must be reported with a date span indicating the first initial visit in the from field and the last visit before delivery in the to field. Claims submitted without the required date span may be denied. Following are the code descriptions:

Reminder: Inappropriate modifier combination with modifier 59 Modifier 59 is used to identify procedures and services, other than evaluation and management services, that aren’t normally reported together but are appropriate under the circumstances. When another already established modifier is appropriate (XE, XP, XS or XU), it should be used rather than modifier 59. In accordance with the Centers for Medicare & Medicaid Services, it’s not appropriate for modifier 59 to be reported with modifiers XE, XP, XS or XU on the same claim line. When these modifiers are billed together, claims may be denied. Following are the modifier descriptions:

Medicare Plus Blue℠ Reminder: Repeat radiology procedures To ensure correct processing of claims, append the appropriate modifier when submitting claims for repeat radiology procedures. Medicare considers two physicians in the same group with the same specialty performing services on the same day as the same physician. Physicians in the same group practice who are in the same specialty must bill and be paid as though they were a single physician. Physicians in the same group practice but who are in different specialties may bill and be paid without regard to their membership in the same group. Claims submitted for repeat radiology procedures without the appropriate modifier may be denied. Modifier 76 definition: Repeat Procedure by the Same Physician; use when it is necessary to report repeat procedures performed on the same day. Modifier 77 definition: Repeat procedure or service by another physician or other qualified health care professional. Note: Please submit a corrected claim; don’t send clinical editing appeals.

Pharmacy news roundupWhat you need to know To view all — including the most recent — pharmacy-related provider alerts:

Starting with this issue of The Record, we’re gathering recent pharmacy-related provider alerts into a single article. Many of these alerts would previously have been published as separate articles. We’re doing this to make it easier for you to review the changes we’ve announced and to save time for readers who also subscribe to Provider Alerts Weekly and are already aware of this information. We’ll continue to publish some pharmacy-related information separately, such as when there isn’t an equivalent provider alert, there are changes we want to make sure you don’t miss or there are updates or additional information following the provider alert. Here are links to pharmacy-related provider alerts from November:

Tip: You can also subscribe to Provider Alerts Weekly to receive a weekly email with links to the previous week’s provider alerts. Availity® is an independent company that contracts with Blue Cross Blue Shield of Michigan and Blue Care Network to offer provider portal and electronic data interchange services.

Commercial prior authorization requests submitted through NovoLogix must be submitted through a different application, starting April 1For most commercial members, health care providers will need to submit prior authorization requests for medical benefit drugs that are currently submitted through the NovoLogix® online tool through a different application. This applies to dates of service on or after April 1, 2025. Blue Cross Blue Shield of Michigan and Blue Care Network will continue to manage the prior authorization and site-of-care requirements for these drugs. Through March 31, 2025, continue to submit these prior authorization requests through NovoLogix. This includes requests involving site-of-care requirements. Watch for additional communications about training opportunities and resources for the application in first-quarter 2025. NovoLogix is an independent company that provides an online prescription drug prior authorization tool for Blue Cross Blue Shield of Michigan and Blue Care Network.

OncoHealth manages our Oncology Value Management program, starting Jan. 1As a reminder, OncoHealth will manage authorizations for oncology and supportive care drugs for most Blue Cross Blue Shield of Michigan commercial and Blue Care Network commercial members and all Medicare Plus Blue℠ and BCN Advantage℠ members through the Oncology Value Management program. This applies to dates of service on or after Jan. 1, 2025. For additional information, see the October Record and the November Record. Start submitting prior authorization requests to OncoHealth on Jan. 1 On Jan. 1, 2025, health care providers will be able to submit prior authorization requests in the OncoHealth Provider Portal, OneUM™, through Availity Essentials™. To access the OncoHealth Provider Portal:

Members who started receiving treatment before Jan. 1, 2025, can continue to receive treatment under their approved authorization until it expires. Authorization isn’t required from OncoHealth unless:

Attend or view a webinar Providers who submit prior authorization requests for oncology drugs should attend a live webinar to learn more. The webinar will:

If you haven’t attended a webinar already, there’s still time. Click one of the links below to register.

If you can’t attend a live webinar, you can view a recorded webinar. To access it, log in to our Provider Training site and search for “oncology.” To access the Provider Training site:

If you have issues accessing or navigating the site, email ProviderTraining@bcbsm.com. Additional information For additional information, see the document Oncology Value Management program through OncoHealth: Frequently asked questions for providers. You can find the FAQ document, lists of medical benefit oncology and supportive care drugs that require prior authorization, and more on the following pages on ereferrals.bcbsm.com: ** Blue Cross Blue Shield of Michigan and Blue Care Network don’t own or control this website. Availity® is an independent company that contracts with Blue Cross Blue Shield of Michigan and Blue Care Network to offer provider portal and electronic data interchange services. OncoHealth is an independent company supporting Blue Cross Blue Shield of Michigan and Blue Care Network by providing cancer support services.

Article correction: Announcing changes to preferred drug designations under medical benefits for most membersIn the November 2024 Record, we published an article with an incorrect drug name. One of the preferred drugs for commercial members for pegfilgrastim is Udenyca Onbody™, not Udenyca OnPro™. We’ve updated the article below with the correct information. For dates of service on or after Jan. 1, 2025, Blue Cross Blue Shield of Michigan and Blue Care Network are making changes to preferred drug designations for some drugs. In addition, health care providers will need to submit prior authorization requests through different systems for some preferred and nonpreferred drugs. These changes will affect:

Changes to preferred drug designations The following table shows how we’re changing preferred drug designations. Changes are in bold text.

How existing prior authorizations are affected by these changes

Changes to prior authorization processes The following table outlines prior authorization requirements for the drugs listed above for dates of service on or after Jan. 1, 2025. Note: To determine which Blue Cross and BCN commercial groups participate in the Oncology Value Management program through OncoHealth® for dates of service on or after Jan. 1, 2025, see this list.

Additional information See the “Find out which medical benefit oncology drugs will require prior authorization through OncoHealth, starting Jan. 1” article for more details about drugs that will have requirements through the Oncology Value Management program for dates of service on or after Jan. 1, 2025. For additional information about medical benefit drugs, read these pages of our ereferrals.bcbsm.com website: OncoHealth is an independent company supporting Blue Cross Blue Shield of Michigan and Blue Care Network by providing cancer support services.

Here are 2025 FEP benefit changesBlue Cross and Blue Shield Federal Employee Program® 2025 benefit changes will take effect Jan. 1, 2025. Below is an overview of the changes. Cost share

Emergency room

Gende-affirming care

Inpatient admission

Office visits

Outpatient laboratory services

Outpatient observation services

Outpatient surgical and treatment

Pharmacy

Reproductive care

Urgent care center

For complete 2025 Blue Cross and Blue Shield Service Benefit Plan benefit information, go to fepblue.org/brochure or call Customer Service at 1-800-482-3600.

Updates to our coverage of limb compression devices, starting Feb. 1, 2025Blue Cross Blue Shield of Michigan and Blue Care Network will change the reimbursement for intermittent limb compression devices to only allow for a one-month rental at a time. Beginning Feb. 1, 2025, payment for the compression device billed with procedure code E0676 will be limited to rental only for services on or after that date; these devices will no longer be eligible for purchase. Members still need to meet the clinical criteria in our medical policies. A new certificate of medical necessity will be required with each monthly rental claim. The certification must indicate that the patient continues to need the device beyond the 30 days and that other conservative measures have been attempted. Payment for all claims that don’t include the medical necessity requirements will be denied. For patients who engage in the postsurgical home use of limb compression devices for venous thromboembolism prophylaxis, one of the following criteria must be met:

Our policy, Postsurgical Home Use of Limb Compression Devices for Venous Thromboembolism Prophylaxis, provides key measurements to assess the risk of bleeding. Additionally, the policy provides the tools to define the Caprini Score as used to assess the risk of VTE. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

No portion of this publication may be copied without the express written permission of Blue Cross Blue Shield of Michigan, except that BCBSM participating health care providers may make copies for their personal use. In no event may any portion of this publication be copied or reprinted and used for commercial purposes by any party other than BCBSM.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||